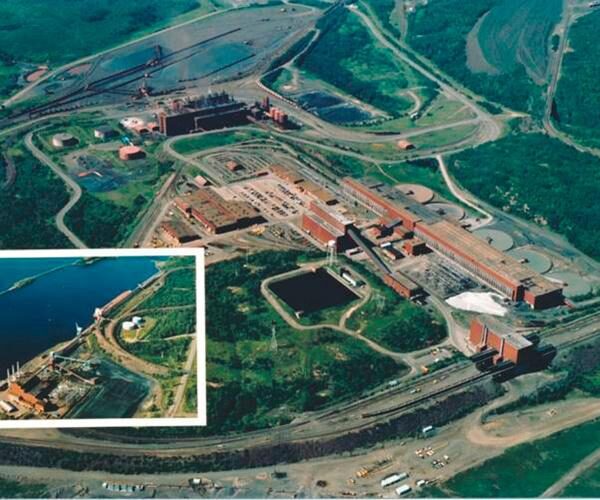

The Erie Mining Co. Scholarship Fund is for graduating seniors at Mesabi East High School. It commemorates the company and its employees by awarding scholarships to students living where the company once operated. Preference is given to students expressing interest in a career in the minerals industry. Erie Mining Co. existed from 1940 to 2001 and was a pioneer in the taconite industry. Erie’s Preliminary Taconite Plant (PreTac) near Aurora was the world’s first commercially successful taconite mine and processing plant. It operated from 1948 to 1957 and proved the technical and economic feasibility of taconite mining and processing. In 1954, construction began on the Erie Commercial Plant near Hoyt Lakes, a power plant and dock at Taconite Harbor on Lake Superior and a railroad connecting the two. The towns of Hoyt Lakes and Taconite Harbor were built for employees and their families. Erie was a leading employer in the area from 1957 to its closure in 2001.

Eligibility

- Graduate of: Mesabi East

- Attending a 2 or 4 year school

- Field of study: Minerals or Mining Industry preferred

Scholarship Grant Range

- $2,000 for one year

Application timeline

- This scholarship is part of the Universal Application: December 1 – February 15

- ONE Universal Application: Create a profile in the scholarship portal. Fill out the first page of the universal application to filter through all of the scholarships you qualify for.

Award Details

- This scholarship may be used for expenses of post-secondary education at any accredited college, university or technical/ vocational school

- Award Payments will be mailed directly to the school/ university

- Fall Payments are mailed July 15-30

- Spring Payments are mailed December 15-30

- Transferring Schools: Please contact DSACF if you plan on transferring schools. Transferring schools does not automatically transfer your scholarship. If a transfer occurs after scholarship money has been disbursed it may take up to 90 days to reprocess the scholarship payment.

Tax information

DSACF encourages scholarship recipients to seek tax advice regarding scholarships. According to the IRS: Scholarships, fellowship grants, and other grants are tax-free if you meet the following conditions:

- You’re a candidate for a degree at an educational institution that maintains a regular faculty and curriculum and normally has a regularly enrolled body of students in attendance at the place where it carries on its educational activities; and

- The amounts you receive are used to pay for tuition and fees required for enrollment or attendance at the educational institution, or for fees, books, supplies, and equipment required for courses at the educational institution.

cook county minnesota mesabi east iron range